In the world of portfolio management, where chasing “hot stocks” and “beating-the-market” seem to rule the day, many investors inevitably lose out, suffering huge losses and destroying their portfolios, or, at best, enduring ongoing stress and uncertainty trying to figure out what to do next.

However, as an investor, a basic knowledge of academic investing science can not only impact your decision-making process and investment planning, but it can ultimately make a huge difference in your investing peace of mind. Below are five insights about academic investing that investors should understand and consider when setting their investment strategy – and selecting their advisor – and why.

1. What is academic investing science?

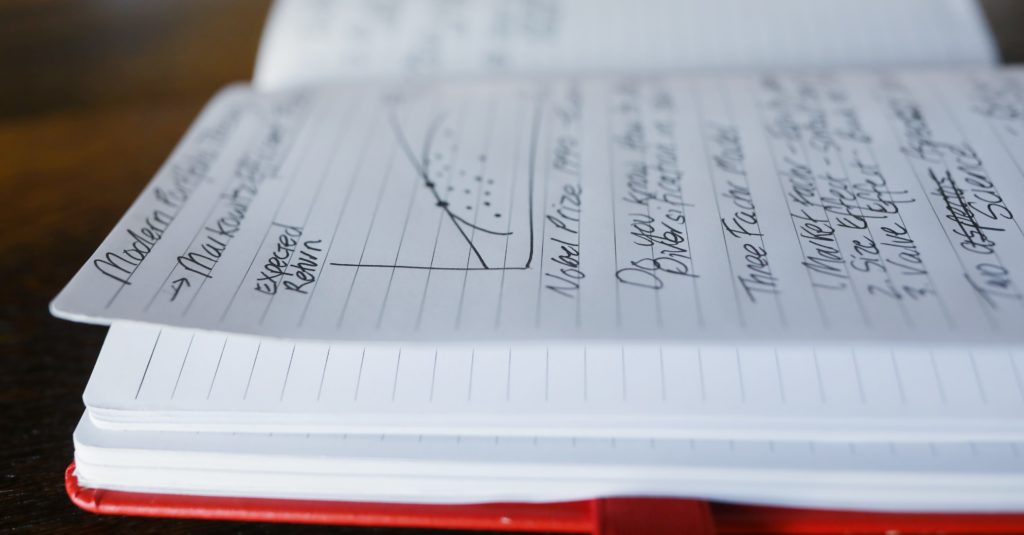

Academic investing science takes decades of research by economic, financial, and behavioral academics such as Eugene Fama, Harry Markowitz, Kenneth French and Meir Statman and applies it to portfolio management. This work has won Nobel Prizes and has provided empirically proven principles that removes the guesswork from portfolio management.

For one thing, this science emphasizes that a disciplined approach to investing via a globally diversified portfolio can produce favorable long-term results. What does this mean for investors? They have access to the education and tools to fulfill on their investment strategy via portfolios that are built to last – empowering them to ride through times of market volatility and uncertainty while staying focused on their life’s financial goals.

2. An indispensable tool for investing

Advisors and firms truly committed to the continuous pursuit of financial academic theory do not pretend to be able to predict the future and get their clients in on a hot tip. Instead, these advisors are out to support the best possible investing experiences for their clients, looking to produce outcomes that balance targeted gains with identified risk tolerances and lifelong investing goals. In this case, investors not only have an advisor but a financial coach who is an indispensable resource who can powerfully develop them to be disciplined and prudent over a lifetime.

3. Where the Academics of Investing, Finance, and Behavioral Science Unite

Inside the world of academic investing science is a subset of categories that comprise a highly disciplined approach to long-term wealth creation. One area is the Nobel Prize winning work of financial and economic academics such as Harry Markowitz, whose work on Modern Portfolio Theory guides the design of portfolios to maximize returns per the desired level of risk, and Eugene Fama, who pioneered the Efficient Market Hypothesis which asserts that stocks trade at their fair market value and investors benefit from investing in strategies designed to capture market rates of return rather than attempting to beat the market.

Another discipline is behavioral finance, seen in the work of experts such as Meir Statman, who looks at how investors and managers make financial decisions and how these decisions are reflected in financial markets. Advisors who base their investment strategy on the most powerful academic investing principles and behavioral science can create a whole new investing experience for their clients. In turn, investors can alter their relationship to investing in such a way that their attitudes and actions around money can transform from stress and uncertainty into empowerment and peace of mind.

4. Taking the guesswork out of investing

Applying academic investing science to portfolio management allows portfolios to be engineered to capture market returns while eliminating the need for stock-picking and market-timing. Applying this science to portfolio management eliminates trying to time when to get back in (or get out) of the market, or which stocks or funds to pick, or which money managers’ advice to follow – empowering investors to stop speculating and gambling with their life’s savings. Having an investment strategy built on academic investing science allows investors to take a prudent, long-term approach to investing and growing their wealth. What does this mean for you? Access to a lifetime of peace of mind around investing… and your future.

5. A rebalancing act

Almost every investor has heard the golden rule: “buy low, sell high”. Academic investing science is a systematic way of putting this in place, where allocations in an investor’s portfolio are evaluated and rebalanced regularly to target optimal results. This approach – based on extensive scholarship and Nobel Prize winning investing science – eliminates the need to chase hot stocks or funds, or time market swings. Rather, it employs a disciplined approach to portfolio management. To quote Harry Markowitz, “A good portfolio is more than a long list of stocks and bonds. It is a balanced whole.”

Conclusion

Owning a portfolio built with academic investing science principles, while partnering with a financial coach who both advocates these principles and stands for a disciplined approach to investing, can allow an investor to know exactly what they are doing with their money… and why.

We invite you to join us and continue to discover this world of academic investing science, and what a breakthrough investing methodology can mean for you, for your money, and for your family’s financial future.

Have a question? Learn more about Matson Money and how we can assist you in the journey to achieving your American Dream? Contact us or email us at connect@matsonmoney.com.