An efficient frontier is a set of hypothetically optimal portfolios, based on selected assets, that offer the highest expected return for a defined level of risk, or the lowest risk for a given level of expected return. Understanding the efficient frontier can help in the construction of prudently diversified portfolios designed for long-term investing and can help investors steer clear of potentially unsystematic risks.

The Efficient Frontier is a cornerstone of Modern Portfolio Theory, a concept that earned Harry Markowitz a Nobel Prize in 1990 and who is a Legacy Member of the Matson Money Academic Advisory Board.

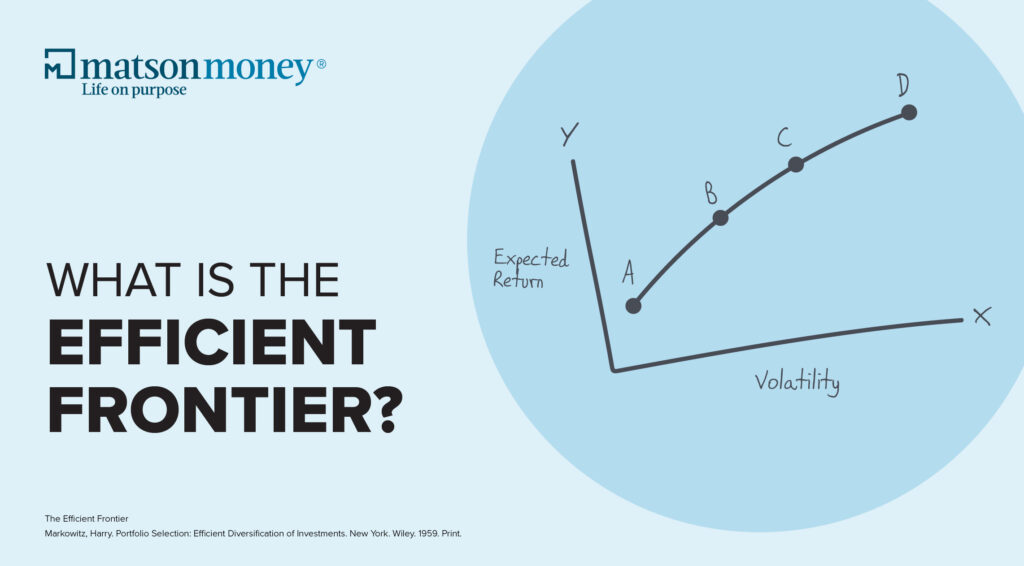

This graphical representation of optimal portfolios is often referred to as ‘efficient’ because, according to certain models, it may offer a balance where other combinations of assets are unlikely to achieve better expected returns without increasing risk or reducing risk without potentially sacrificing expected returns. In a graph where the x-axis represents volatility and the y-axis represents expected returns, an efficient frontier forms a curve that demonstrates the trade-off between risk and return.

Diversification is essential in constructing portfolios on an efficient frontier. Adding assets with dissimilar price movements can help reduce volatility in a portfolio because if one asset is down, it is possible that some others in the portfolio are up, or vice versa. In this way, not all investments are placed in the same asset or type of asset in the portfolio, all of which can vary with normal market fluctuations. This strategy capitalizes on the fact that the price movements of different assets are not perfectly correlated, which can help allow the portfolio to withstand market ups and downs over time.

As an example, diversifying your portfolio with both stocks and bonds would likely result in a portfolio with a lower standard deviation than a portfolio containing only stocks, as bonds are historically less risky than stocks. Adding or removing an asset or asset class from your portfolio would likely result in a different efficient frontier. This prudent diversification can help mitigate potential risks and can help enhance the potential for long-term expected returns.

Constructing a Prudently Diversified Portfolio

Creating an efficient, prudent portfolio designed to land on an efficient frontier involves the following:

- Selection of Assets – We choose a diverse set of assets with varying risk and return profiles.

- Expected Returns and Risk Calculation – We calculate the expected return and risk for each asset based on historical data.

- Correlation Analysis – We determine the correlation between the historical returns of different assets to help maximize expected return(s).

Understanding and applying the efficient frontier in prudent, long-term investing can offer several potential benefits:

- Optimized Expected Returns – Constructing portfolios on an efficient frontier can help ensure the highest expected possible returns for chosen risk levels.

- Risk Management – One of the purposes of diversification is that it can help reduce the impact of market volatility and can help protect investments during turbulent times.

- Benchmarking performance – an efficient frontier can provide an academic benchmark for evaluating portfolio performance, assessing whether the portfolio delivers optimal expected returns for a given level of risk.

Our investment approach at Matson Money, the Free Market Portfolio Theory, is based on years of academic investing research and established financial theories. Our portfolios are constructed on a prudent basis so several asset classes with different correlations combine with one another to seek to reduce volatility, a basic framework for examining risk/reward trade-offs.

If you need assistance in reviewing your portfolio, please contact us at connect@matsonmoney.com to get connected with a co-advisor who works with Matson Money to have a Portfolio MRI® completed. The Portfolio MRI® is a diagnostic measure of your current investment information. The purpose of this personalized Portfolio MRI® is to help you understand how various mixes or styles of investment portfolios may have performed in the past.

DISCLOSURES:

This content is based on the views, opinions, beliefs, or viewpoints of Matson Money, Inc. This content is not to be considered investment advice and is not to be relied upon as the basis for entering into any transaction or advisory relationship or making any investment decision.

All of Matson Money’s advisory services are marketed almost exclusively by either Solicitors or Co-Advisors. Both Co-Advisors and Solicitors are independent contractors, not employees or agents of Matson.

Other financial organizations may analyze investments and take a different approach to investing than that of Matson Money. All investing involves risks and costs. No investment strategy (including asset allocation and diversification strategies) can ensure peace of mind, guarantee profit, or protect against loss.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS

This content is for educational purposes only. Investors cannot invest in a market index directly, and the performance of an index does not represent any actual transactions. The performance of an index does not include the deduction of various fees and expenses which would lower returns. Advisory fees charged to Matson Money clients, whether directly or indirectly through a mutual fund, are described in Matson Money’s Form ADV Part 2A and Form CRS, available at www.matsonmoney.com. PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

Data prior to the launch date of the index is hypothetical back-tested data (i.e. calculations of how the index might have performed over that time period had the index existed). There are frequently material differences between hypothetical back-tested performance and actual results. Past performance — whether actual or back-tested — is no indication or guarantee of future performance. Hypothetical back-tested performance is used by Matson for educational purposes only and is intended only to demonstrate how the market has historically behaved. Matson does not configure, alter, or otherwise use hypothetical back-tested information in an attempt to artificially enhance or impair performance. Matson only uses hypothetical performance information that is relevant to the financial situation and investment objectives of the recipient as communicated to Matson.

The Nobel Memorial Prize in Economic Sciences, commonly referred to as the Nobel Prize in Economics, is an award for outstanding contributions to the field of economics, and generally regarded as the most prestigious award for that field.

Markowitz, Harry. “Portfolio Selection.” Journal of Finance. 1952.

Harry Max Markowitz is an American economist, and a recipient of the 1989 John von Neumann Theory Prize and the 1990 Nobel Memorial Prize in Economic Sciences. Markowitz is a professor of finance at the Rady School of Management at the University of California, San Diego.

Efficient Market Hypothesis, first explained by Dr. Eugene Fama in his 1965 doctoral thesis.

Eugene F. Fama, “Random Walks in Stock Market Prices,” Financial Analysts Journal, September/October 1965.

Eugene F. Fama, 2013 Nobel laureate in Economic Sciences; is widely recognized as the “father of modern finance.” His research is well known in both the academic and investment communities. He is strongly identified with research on markets, particularly the Efficient Market Hypothesis.

Three Factor Model

Fama, Eugene F. and Kenneth R. French. “The Cross-Section of Expected Stock Returns,” Journal of Finance, 47, June 1992.

Efficient Market Hypothesis

Eugene F. Fama, “Random Walks in Stock Market Prices,” Financial Analysts Journal, September/October 1965.

Modern Portfolio Theory

Markowitz, Harry. Portfolio Selection: Efficient Diversification of Investments. New York. Wiley. 1959. Print.

Free Market Portfolio TheoryTM is based on a synthesis of research performed by Brinson, Hood & Beebower, the Efficient Market Hypothesis, first explained by Dr. Eugene Fama in his 1965 doctorial thesis and which was explained further by Harry Markowitz in “Portfolio Selection”, Journal of finance; Modern Portfolio Theory, based on the collaborative work of Harry Markowitz, Merton Miller, and William Sharpe; and The 3 Factor Model, created by Dr. Eugene Fama and Kenneth French in 1991.

Academic Advisory Board members generally receive compensation from Matson Money for their services which include, but are not limited to, independent leadership consulting; co-authoring white papers; and speaking at Matson Money conferences. Advisory Board members may also provide insight to Matson Money on portfolio construction, asset allocation, quantitative analysis, investor behavior and other areas of expertise, as needed. Certain Advisory Board members are employed by or otherwise affiliated with third party advisory firms that offer funds in which Client accounts are invested.