Modern Portfolio Theory (MPT) is a method of investment selection that focuses on maximizing expected returns for an acceptable level of risk. 1

First Introduced by Harry Markowitz in 1952 in his “Portfolio Selection” published work in the Journal of Finance, Modern Portfolio Theory has become a key tool for Matson Money’s Free Market Portfolio Theory™*. 1

Modern Portfolio Theory was developed based upon several assumptions:

- Investors’ goals are to maximize their returns

- Investors do not like to take on risks

- Investors look at the risk and returns on all their investments

- Investors all have the same exact knowledge and information on their investments

- Investments are all efficiently priced 2

Two Fundamentals of Modern Portfolio Theory:

- Risk and Return

- Diversification 3

Risk and Return Relationship

As described in Modern Portfolio Theory, the relationship between risk and returns in your portfolio is not the sum of your individual holdings, but rather how your individual holdings interact with each other.

A portfolio’s overall risk can potentially be reduced if the holdings are not perfectly correlated. Having uncorrelated assets can help “smooth out” a portfolio’s risk (as represented by the standard deviation).3 Correlation shows the strength of a relationship between two variables, it is a statistic that measures the degree to which two securities move in relation to each other. Correlation is the concept that certain types of risk can be mitigated by investing in assets that are not correlated. A perfect positive correlation implies that as one security moves, either up or down, the other security moves in lockstep, in the same direction. A perfect negative correlation means that two assets move in opposite directions, while a zero correlation implies no linear relationship at all. Building portfolios with assets that are not perfectly correlated can help balance the effects of market volatility in the overall portfolio without [over] focusing on one particular asset type.

Importance of Diversification in MPT

With diversification, you can spread your investments across a variety of assets which can help reduce the overall risk of a portfolio.

Different Types of Risks

With Modern Portfolio Theory, while maximizing expected returns being one goal, the other goal is to minimize risks. There are two risk categories that the theory addresses:

- Systematic Risk – macro-level risks that are shared in a market or are industry-wide such as interest rate changes, inflation, wars, pandemics, and recessions. 3

- Unsystematic Risk – micro-level risks that are specific to individual stocks such as leadership changes in a company, layoffs, financial obligations, or location changes. 4

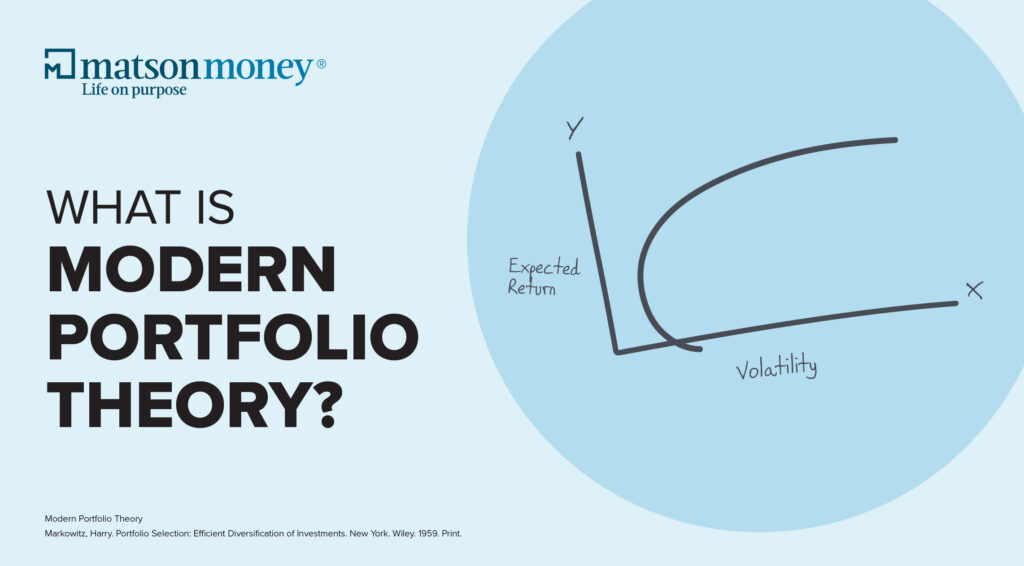

Efficient Frontier

Modern Portfolio Theory complements the Efficient Market Hypothesis in supporting the potential benefits of passive management and diversification as investment strategies. Utilizing Modern Portfolio Theory, an investor’s portfolio is more likely to be mapped on an Efficient Frontier. This means that the portfolio is constructed such that it is prudently diversified, thereby maximizing expected returns for the level of risk the investor is willing to accept. This investor, then is, as Founder and CEO of Matson Money says, “owning the market, not playing the market.” 5

Requires Discipline

Referring back to the assumptions mentioned at the beginning, in order for Modern Portfolio Theory to be effective as an investment strategy, the investor needs to be rational. Being rational means to be “able to think clearly, sensibly, and logically.” 6 In reality, this is not always the case when it comes to humans, especially concerning their investments. The investment selection can be only half the battle. The behavioral aspect in your investments plays a key role as you invest for your future. The human behavior component is a key component to portfolio construction and training and development at Matson Money.

As we pursue our commitment to being a premier investor coaching company, Matson Money relies on the insight and industry knowledge of our Academic Advisory Board. Matson Money’s Academic Advisory Board is comprised of luminaries in their respective fields that bring expertise in these critical aspects of what it means to be an investor and how to leverage the power of free markets. The board included Harry Markowitz (prior to his passing in 2023), one of the original developers of Modern Portfolio Theory and David Eagleman, a neuroscientist at Stanford University, an international best-selling author of Livewired, The Runaway Species, The Brain, Incognito, and Wednesday is Indigo Blue.

If you want to learn more about how you can implement Modern Portfolio Theory through Matson Money’s Free Market Portfolio Theory with your investments, visit our Connect With An Advisor page to get started.

References

- Baldridge, R. (2023, January 3). Understanding modern portfolio theory. Forbes Advisor. https://www.forbes.com/advisor/investing/modern-portfolio-theory/

- Assumptions of modern portfolio theory — Yochaa. (n.d.). Yochaa. https://yochaa.com/assumptions-of-modern-portfolio-theory

- Modern portfolio theory. (2023, August 22). GuidedChoice. https://guidedchoice.com/modern-portfolio-theory/

- The basics of modern portfolio theory, explained. (n.d.). Raseed Dev. https://raseeddev.com/en/learn/the-basics-of-modern-portfolio-theory-explained

- McClure, B. (2023, July 6). Modern portfolio theory: Why it’s still hip. Investopedia. https://www.investopedia.com/managing-wealth/modern-portfolio-theory-why-its-still-hip/

- Definition of rational. (n.d.). Wordsmyth Word Explorer Children’s Dictionary; WILD dictionary K-2 | Wordsmyth. https://kids.wordsmyth.net/we/?level=2&rid=34161

DISCLOSURES:

This content is based on the views, opinions, beliefs, or viewpoints of Matson Money, Inc. This content is not to be considered investment advice and is not to be relied upon as the basis for entering into any transaction or advisory relationship or making any investment decision.

All of Matson Money’s advisory services are marketed almost exclusively by either Solicitors or Co-Advisors. Both Co-Advisors and Solicitors are independent contractors, not employees or agents of Matson.

Other financial organizations may analyze investments and take a different approach to investing than that of Matson Money. All investing involves risks and costs. No investment strategy (including asset allocation and diversification strategies) can ensure peace of mind, guarantee profit, or protect against loss.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS

Free Market Portfolio Theory™ is based on a synthesis of research performed by Brinson, Hood & Beebower, the Efficient Market Hypothesis, first explained by Dr. Eugene Fama in his 1965 doctoral thesis and which was explained further by Harry Markowitz in “Portfolio Selection”, Journal of finance; Modern Portfolio Theory, based on the collaborative work of Harry Markowitz, Merton Miller, and William Sharpe; and The 3 Factor Model, created by Dr. Eugene Fama and Kenneth French in 1991.

Three Factor Model

Fama, Eugene F. and Kenneth R. French. “The Cross-Section of Expected Stock Returns,” Journal of Finance, 47, June 1992.

Efficient Market Hypothesis

Eugene F. Fama, “Random Walks in Stock Market Prices,” Financial Analysts Journal, September/October 1965.

Modern Portfolio Theory

Markowitz, Harry. Portfolio Selection: Efficient Diversification of Investments. New York. Wiley. 1959. Print.

The Nobel Memorial Prize in Economic Sciences, commonly referred to as the Nobel Prize in Economics, is an award for outstanding contributions to the field of economics, and generally regarded as the most prestigious award for that field.

Markowitz, Harry. “Portfolio Selection.” Journal of Finance. 1952.

Harry Max Markowitz is an American economist, and a recipient of the 1989 John von Neumann Theory Prize and the 1990 Nobel Memorial Prize in Economic Sciences. Markowitz is a professor of finance at the Rady School of Management at the University of California, San Diego.

Efficient Market Hypothesis, first explained by Dr. Eugene Fama in his 1965 doctoral thesis.

Eugene F. Fama, “Random Walks in Stock Market Prices,” Financial Analysts Journal, September/October 1965.

Eugene F. Fama, 2013 Nobel laureate in Economic Sciences; is widely recognized as the “father of modern finance.” His research is well known in both the academic and investment communities. He is strongly identified with research on markets, particularly the Efficient Market Hypothesis.

Academic Advisory Board members generally receive compensation from Matson Money for their services which include, but are not limited to, independent leadership consulting; co-authoring white papers; and speaking at Matson Money conferences. Advisory Board members may also provide insight to Matson Money on portfolio construction, asset allocation, quantitative analysis, investor behavior and other areas of expertise, as needed. Certain Advisory Board members are employed by or otherwise affiliated with third party advisory firms that offer funds in which Client accounts are invested.